Health Reimbursement Arrangements

Is Your Health Insurance Plan Up To Date?

In dealing with the rising cost of health care and insurance, we suggest the 80/20 rule:

Are you spending valuable premium dollars to cover health expenses which rarely happen?

Many of our clients are using a new cost effective approach to offering health insurance to their employees

without a reduction in medical benefits. The HRA (Health Reimbursement Arrangement) allows you to provide

your employees the medical benefits they need when they need them: when there is a claim. You reduce your

overall premium expense and use the savings to help fund medical claims when and if they occur. This

approach is similar to a self-funding insurance plan used by large companies with flexible benefit parameters

and minimal administration. Depending on your situation, an HRA could be the best way for your business to

address the rising cost of health care.

For Example: An employer with 15 enrolled members changes from a $ 1000 deductible plan to a $ 2500

deductible plan with a $ 1500 HRA benefit. The employee is responsible for the first $ 1000 in claims. The

employer pays the next $ 1500 in claims (the HRA benefit). After $ 2500 in claims, the deductible is exhausted

and the coinsurance benefit is applied.

In dealing with the rising cost of health care and insurance, we suggest the 80/20 rule:

- 82% of US have annual medical expenses of less than $1000

- 40% of US have annual medical expenses of less than $500

- 33% have no medical expenses and only 11% have expenses of over $2000

Are you spending valuable premium dollars to cover health expenses which rarely happen?

Many of our clients are using a new cost effective approach to offering health insurance to their employees

without a reduction in medical benefits. The HRA (Health Reimbursement Arrangement) allows you to provide

your employees the medical benefits they need when they need them: when there is a claim. You reduce your

overall premium expense and use the savings to help fund medical claims when and if they occur. This

approach is similar to a self-funding insurance plan used by large companies with flexible benefit parameters

and minimal administration. Depending on your situation, an HRA could be the best way for your business to

address the rising cost of health care.

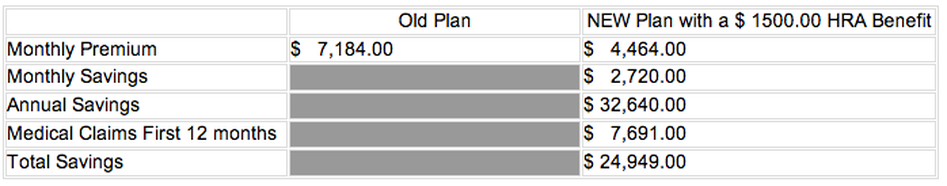

For Example: An employer with 15 enrolled members changes from a $ 1000 deductible plan to a $ 2500

deductible plan with a $ 1500 HRA benefit. The employee is responsible for the first $ 1000 in claims. The

employer pays the next $ 1500 in claims (the HRA benefit). After $ 2500 in claims, the deductible is exhausted

and the coinsurance benefit is applied.

These are actual figures from one of our clients. We can help you set up an HRA to meet the needs of your

business. We offer HRA plans with seemless administration at no additional cost to you.

“Our company has been working with Trout Insurance for the last five years. They have worked consistently to adapt our benefits to fit our needs and control our premium dollars. Even with our small company of five employees, Trout Insurance was able to save us over $18,000 for the upcoming renewal year.” Dan English, Employee Administrative Services Inc.

business. We offer HRA plans with seemless administration at no additional cost to you.

“Our company has been working with Trout Insurance for the last five years. They have worked consistently to adapt our benefits to fit our needs and control our premium dollars. Even with our small company of five employees, Trout Insurance was able to save us over $18,000 for the upcoming renewal year.” Dan English, Employee Administrative Services Inc.