Have you lost your Premium Subsidy ?

The most common reason for losing your premium tax credit aka "Subsidy" is the reconciliation of your

actual income versus your estimated income and your premium tax credit was not reported on past

taxes.

This reconciliation would be reported on the 8962 form completed by your accountant. This is completed after you received the 1095A form from the marketplace or your insurance company.

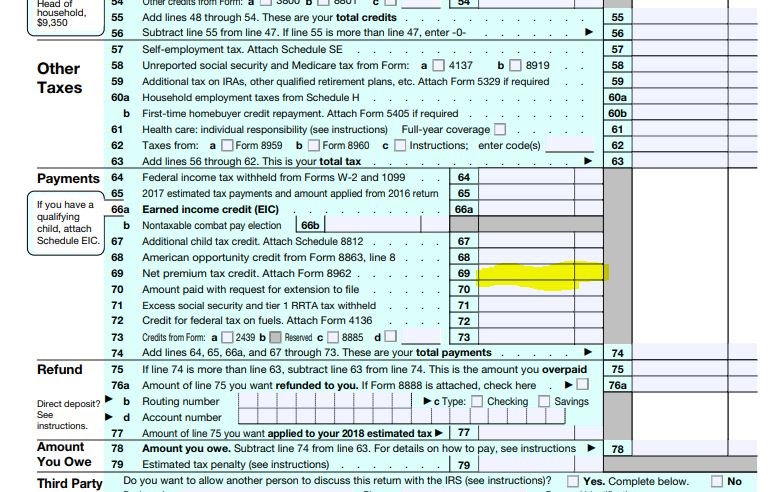

Your premium tax credit reconciliation would be reported on line 69 on page 2 of your 1040:

- If you made more money than you estimated, line 69 would indicate that tax would be due back

- to the federal government

- If you made less money than you estimated, line 69 would indicate a tax credit to you

- In any case, line 69 should be completed with some value

- If this was NOT completed – this is a common reason that you have lost your premium tax credit

If you fall into this category, you can take the following steps:

- Check your 1040 from 2017, 2016 and 2015 to see if line 69 on page 2 was left blank. If that line was blank – especially for later years – you will need to get an amended tax return

- Call the Health Insurance Marketplace 800-318-2596 to get the 1095A mailed to you

Other factors that affect loss of premium tax credit:

- Change in household size: if you got married, divorced, had a baby or had a dependent age out (turned 26). Any change in the number of people on your tax return

- Substantial change in income: either plus or minus 25% as compared to 2017 this would be the latest tax return filing that the marketplace has access to

- Having filed an extension on your tax returns or if your 2017 taxes aren’t complete

Contact us – we can help!