-

Insurance

- Trout Team

-

Resources

-

Community

- 50+ WNC Articles

- Understanding Medicare 2024

- Weaverville Primary Spring Fling

- Alignment's 5-Star Switch

- Employer Networking w/ Just Economics

- FALLing with Families

- Blue Ridge Pride Festival

- Goombay & YMI

- YMI Winter Coat Drive

- Medicare Seminar

- Art in Autumn + MANNA

- Music on Main

- Western Women's Business Center Conference

- Mural on Main Street

- Back to School

- Weaverology

- Contact Us

|

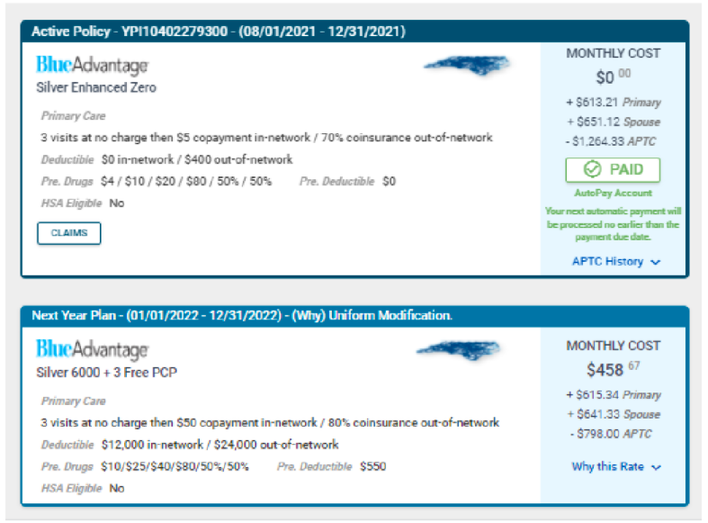

Consumers who claimed Unemployment during 2021 had a Special Enrollment Period and qualified for an “enhanced Silver plan with ZERO premium."

For 2022 - this program has ended! Insurance companies must offer renewal at most similar plan - in this case Silver 6000 with subsidy auto generated by the Marketplace. |

Married F&B Team - Chef and Front of House Manager, ages 43 and 41 with one child (Medicaid)

(Actual couple at local restaurant).

Combined Salary = $75,000

RENEWAL OPTIONS

(Actual couple at local restaurant).

Combined Salary = $75,000

RENEWAL OPTIONS

Press Release from Dave Trout: January 1, 2022

“No Unemployment Health Insurance benefit in 2022 & Open Enrollment Still Open”

KEY POINTS

Background - The ARP and Increased Insurance Benefits

As part of the American Rescue Plan ( APR), many aspects of Health Insurance Marketplace rules and calculations were changed and upgraded. These included increases in subsidies for premiums, the removal of the “ income cap “ on subsidies for families making more than 400% of the Federal Poverty Rate and forgiveness on 2020 reconciliation payments. Open Enrollment is extended to January 15, 2022.

And... Low or No Cost Insurance for people who filed for Unemployment Benefits.

This last aspect of the APR went into place on July 1, 2021. Consumers who were unemployed or had filed for unemployment for at least one week were eligible to update their coverage. They then qualified for a Zero premium plan based on the greatest coverage option available. For us in western NC, this was a plan with copays for primary care doctors at 100% for the first three visits then $5 copay, $ 4 for genetics medications, zero deductible for hospitalization or major medical with an annual out of pocket maximum of $ 700.

This benefit provided great peace of mind and excellent coverage for workers faced with the disruptions caused by the pandemic. Faced with unemployment and the uncertainly of getting back to work, at least this one aspect of concern was addressed.

Natalie and Clifford King work in the restaurant business here locally in Asheville. Restaurants were and are among the areas in the economy hit hardest by Covid lockdowns and the uncertainly of reopening, reduced hours and pay, dealing with childcare and remote learning. The King’s were able to apply and benefit from this program.

No Unemployment Plan Renewal for 2022

This aspect of the ARP was for 2021, Only. The plan and premium they had will be different for 2022. Additionally, the renewal information they received either from the Marketplace or the insurance company did not specifically address the non- renewal of this program. Even on Healthcare.gov, finding this is a challenge, hidden under a footnote at the bottom of a single page. ( See below )

The insurance company renewal paperwork is defined by federal regulations and listed their renewal as based on 2022 plans but on subsidy calculations from 2021. For the Kings, the renewal still showed zero net premium.

It was only when their insurance agent, Dave Trout dug into their renewal and Natalie and Clifford got their bill in early December and found that their 2022 plan would be $ 458 monthly.

Action was needed. The Kings along with their agent found a new plan which met their needs at a small fraction of the price. As the change was made prior to December 15, the new plan and an affordable premium will start January 1.

Open Enrollment Still Open – New Plans - January 15 deadline.

Many people who benefited from the ARP Unemployment benefit may not have seen or become aware of their new premium until they receive their bill or have their account drafted with a skyrocket payment. Or even if the premium is not extraordinarily greater, the plan may have changed from the Enhanced Silver Zero. Insurance companies may suggest alternate plans but these may not meet your needs or budget.

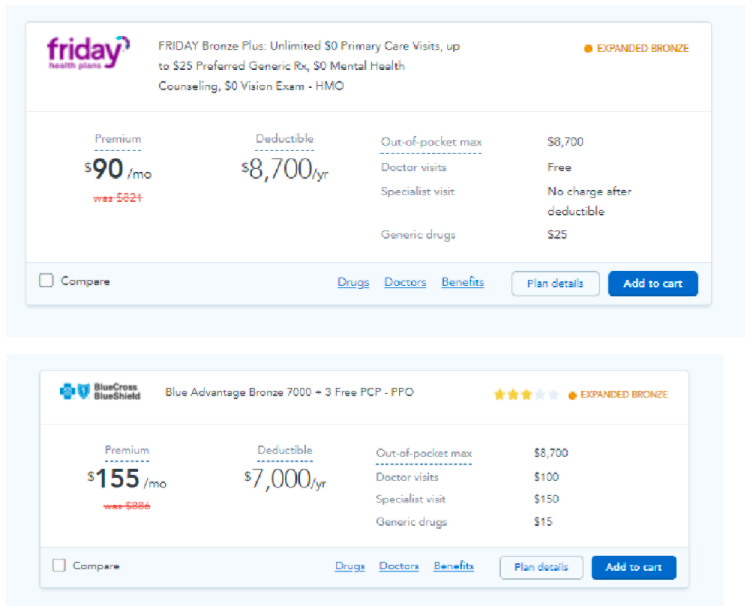

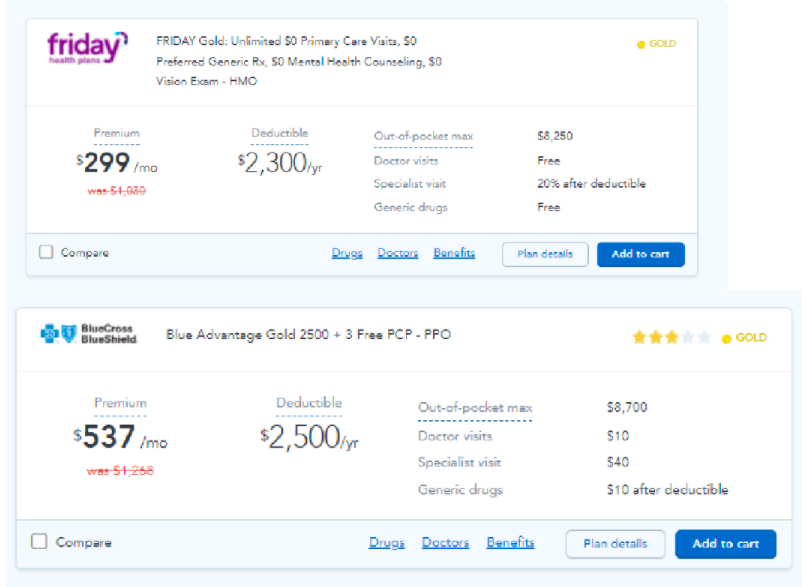

For 2022, there are new plans and new companies offering excellent plans in WNC. Looking at Healthcare.gov, there are 124 different plans available. Even more, if you should qualify for CSR’s – cost share reductions. The details of these plans differ and some doctors or hospitals may or may not be accepting a specific plan.

On the plus side, there are coverage options that may actually be stronger than the renewal plan. And the premium savings can be substantial $ 100, $ 200, $ 300 monthly or more.

Take the time to review all the details of your coverage, subsidy and premium options. And use the expertise of insurance brokers or navigators who are certified to work with consumers on Healthcare.gov at no cost to you.

If you do not take action, whatever premium and plan was at the time of your renewal months ago and automated adjustment by the Marketplace will be the coverage you will have for 2022. You must act on or before January 15 to have the new plan and premium start on February 1, 2022.

Natalie King is the General Manager of Zambia’s in downtown Asheville.

Dave Trout is an independent insurance broker here in WNC. He has worked on the Health Insurance Marketplace since day one back in 2013, helping thousands of consumers over the last 8 years. www.troutinsurance.com

Sources

https://www.healthcare.gov/unemployed/coverage/

Will I get the same savings on my 2022 Marketplace health coverage as I did in 2021?

If you or someone in your household got unemployment income for at least one week in 2021, your whole household may have been eligible for more savings and lower costs on a Marketplace plan. Because this one-time extra savings is no longer available for 2022 Marketplace coverage, you may get less financial help.

https://www.cms.gov/newsroom/press-releases/american-rescue-plan-lowers-health-insurance-costs-americans-who-may-have-lost-their-job

https://www.healthaffairs.org/do/10.1377/hblog20210709.255087/full/

https://www.bluecrossnc.com/sites/default/files/document/attachment/shopper/public/pdf/sbc/Blue_Advantage_Silver_Enhanced_Zero_6300_2021.pdf

KEY POINTS

- Unemployment Health Insurance Benefit Not Renewed.

- Confusing Information from Insurance Companies & Healthcare.Gov

- Increasing Premiums, Changing Benefit Plans

- Additional Time to Review & Renew – January 15

- More Cost Effective Options

Background - The ARP and Increased Insurance Benefits

As part of the American Rescue Plan ( APR), many aspects of Health Insurance Marketplace rules and calculations were changed and upgraded. These included increases in subsidies for premiums, the removal of the “ income cap “ on subsidies for families making more than 400% of the Federal Poverty Rate and forgiveness on 2020 reconciliation payments. Open Enrollment is extended to January 15, 2022.

And... Low or No Cost Insurance for people who filed for Unemployment Benefits.

This last aspect of the APR went into place on July 1, 2021. Consumers who were unemployed or had filed for unemployment for at least one week were eligible to update their coverage. They then qualified for a Zero premium plan based on the greatest coverage option available. For us in western NC, this was a plan with copays for primary care doctors at 100% for the first three visits then $5 copay, $ 4 for genetics medications, zero deductible for hospitalization or major medical with an annual out of pocket maximum of $ 700.

This benefit provided great peace of mind and excellent coverage for workers faced with the disruptions caused by the pandemic. Faced with unemployment and the uncertainly of getting back to work, at least this one aspect of concern was addressed.

Natalie and Clifford King work in the restaurant business here locally in Asheville. Restaurants were and are among the areas in the economy hit hardest by Covid lockdowns and the uncertainly of reopening, reduced hours and pay, dealing with childcare and remote learning. The King’s were able to apply and benefit from this program.

No Unemployment Plan Renewal for 2022

This aspect of the ARP was for 2021, Only. The plan and premium they had will be different for 2022. Additionally, the renewal information they received either from the Marketplace or the insurance company did not specifically address the non- renewal of this program. Even on Healthcare.gov, finding this is a challenge, hidden under a footnote at the bottom of a single page. ( See below )

The insurance company renewal paperwork is defined by federal regulations and listed their renewal as based on 2022 plans but on subsidy calculations from 2021. For the Kings, the renewal still showed zero net premium.

It was only when their insurance agent, Dave Trout dug into their renewal and Natalie and Clifford got their bill in early December and found that their 2022 plan would be $ 458 monthly.

Action was needed. The Kings along with their agent found a new plan which met their needs at a small fraction of the price. As the change was made prior to December 15, the new plan and an affordable premium will start January 1.

Open Enrollment Still Open – New Plans - January 15 deadline.

Many people who benefited from the ARP Unemployment benefit may not have seen or become aware of their new premium until they receive their bill or have their account drafted with a skyrocket payment. Or even if the premium is not extraordinarily greater, the plan may have changed from the Enhanced Silver Zero. Insurance companies may suggest alternate plans but these may not meet your needs or budget.

For 2022, there are new plans and new companies offering excellent plans in WNC. Looking at Healthcare.gov, there are 124 different plans available. Even more, if you should qualify for CSR’s – cost share reductions. The details of these plans differ and some doctors or hospitals may or may not be accepting a specific plan.

On the plus side, there are coverage options that may actually be stronger than the renewal plan. And the premium savings can be substantial $ 100, $ 200, $ 300 monthly or more.

Take the time to review all the details of your coverage, subsidy and premium options. And use the expertise of insurance brokers or navigators who are certified to work with consumers on Healthcare.gov at no cost to you.

If you do not take action, whatever premium and plan was at the time of your renewal months ago and automated adjustment by the Marketplace will be the coverage you will have for 2022. You must act on or before January 15 to have the new plan and premium start on February 1, 2022.

Natalie King is the General Manager of Zambia’s in downtown Asheville.

Dave Trout is an independent insurance broker here in WNC. He has worked on the Health Insurance Marketplace since day one back in 2013, helping thousands of consumers over the last 8 years. www.troutinsurance.com

Sources

https://www.healthcare.gov/unemployed/coverage/

Will I get the same savings on my 2022 Marketplace health coverage as I did in 2021?

If you or someone in your household got unemployment income for at least one week in 2021, your whole household may have been eligible for more savings and lower costs on a Marketplace plan. Because this one-time extra savings is no longer available for 2022 Marketplace coverage, you may get less financial help.

https://www.cms.gov/newsroom/press-releases/american-rescue-plan-lowers-health-insurance-costs-americans-who-may-have-lost-their-job

https://www.healthaffairs.org/do/10.1377/hblog20210709.255087/full/

https://www.bluecrossnc.com/sites/default/files/document/attachment/shopper/public/pdf/sbc/Blue_Advantage_Silver_Enhanced_Zero_6300_2021.pdf

“We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or call 1.800.Medicare to get information on all of your options.”

Trout Insurance is an independent authorized agency licensed to sell and promote products from Blue Cross and Blue Shield of North Carolina (Blue Cross NC). The content contained in this site is maintained by Trout Insurance. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association. ®, SM Registered marks of the Blue Cross and Blue Shield Association.”

|

Effective June 28, 2024; Jessica Cody & Jeremy Sheridan are no longer associated or appointed with or through Trout Insurance Services, Inc.

They may be reached at 828-713-8640 – Cody, 828-606-7994 – Sheridan.

This is an amiable separation and they have our confidence they will continue to act as the professional agents as they have demonstrated over the years with TIS. Our agreement includes provisions that they will retain the agreed policies which they previously directly managed under the Trout Insurance agency license. They will be initiating “Agent of Record Transfers “ to their new agency and /or insurance companies and we will honor those requests. Until those transfers are effective, Trout Insurance retains the fiduciary responsibility under our North Carolina Department of Insurance license & obligations to service your policy. Our commitment is to do so in a polite, effective and efficient manner.

Please send any and all requests and questions to this designated email address: [email protected] or call 828 – 519-5218. these are monitored daily. Please allow three working days for our response and resolution. Please further note that policy changes may not be changed or bound via voicemail or merely email. Per insurance regulations, a licensed agent appointed by that company must make the change.

They may be reached at 828-713-8640 – Cody, 828-606-7994 – Sheridan.

This is an amiable separation and they have our confidence they will continue to act as the professional agents as they have demonstrated over the years with TIS. Our agreement includes provisions that they will retain the agreed policies which they previously directly managed under the Trout Insurance agency license. They will be initiating “Agent of Record Transfers “ to their new agency and /or insurance companies and we will honor those requests. Until those transfers are effective, Trout Insurance retains the fiduciary responsibility under our North Carolina Department of Insurance license & obligations to service your policy. Our commitment is to do so in a polite, effective and efficient manner.

Please send any and all requests and questions to this designated email address: [email protected] or call 828 – 519-5218. these are monitored daily. Please allow three working days for our response and resolution. Please further note that policy changes may not be changed or bound via voicemail or merely email. Per insurance regulations, a licensed agent appointed by that company must make the change.

-

Insurance

- Trout Team

-

Resources

-

Community

- 50+ WNC Articles

- Understanding Medicare 2024

- Weaverville Primary Spring Fling

- Alignment's 5-Star Switch

- Employer Networking w/ Just Economics

- FALLing with Families

- Blue Ridge Pride Festival

- Goombay & YMI

- YMI Winter Coat Drive

- Medicare Seminar

- Art in Autumn + MANNA

- Music on Main

- Western Women's Business Center Conference

- Mural on Main Street

- Back to School

- Weaverology

- Contact Us