Health Insurance Marketplace Requesting Proof of Income?

Follow these 4 Easy Steps:

Step 1.

Download this form to help you organize your documents to send in.

Step 2.

Look at your Eligibility Letter

A.) Locate your Barcode page usually located on page 7, 8 or 9 - MAKE A COPY of this page to send in. It'll look like this:

B.) Find your DEADLINE usually located on Page 3, 4 or 5.

If the Marketplace is requesting proof of income, they have or will be sending you an email or letter regarding this issue. The most important line in this letter is the last, providing a deadline to submit documents.

If you do not provide proof of income to the Health Insurance Marketplace by this date, your 2017 tax credit amount, lower copayments, coinsurance, and deductibles can be terminated.

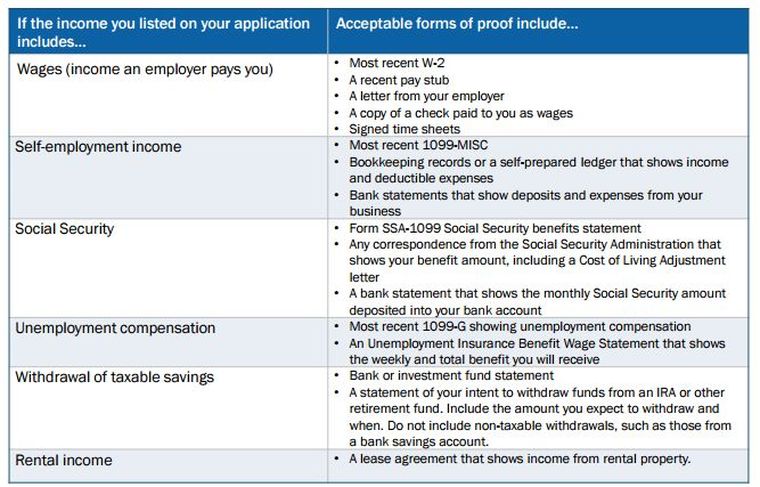

In order to secure your discount from the government for 2017, you must submit proof of income. These include:

If you do not provide proof of income to the Health Insurance Marketplace by this date, your 2017 tax credit amount, lower copayments, coinsurance, and deductibles can be terminated.

In order to secure your discount from the government for 2017, you must submit proof of income. These include:

Remember, the Marketplace is asking you for a projection of your income for 2017.

This can be confusing and difficult for some folks, but the government isn’t asking you to be a fortune teller. If you have hard evidence that your income will go up or down in 2017, send it in to the Marketplace. Otherwise, your proof of your yearly income for 2016 is sufficient.

AND – Most Important - The Marketplace wants verification that you WILL have taxable income for 2017.

Your premium discount is technically an “ IRS “ thing – advanceable premium tax credit

Step 3.

Print this information on EACH PAGE of EACH DOCUMENT

Step 4.

Please scan all of these documents in .pdf format and send all documents to [email protected]

WE will check it over, make sure you have everything that's needed and upload it to your Healthcare account.

If you cannot scan your documents, send us a COPY of all of your documents to:

Trout Insurance

PO Box 1414

Weaverville, NC 28787

Send all your information include the last page of the eligibility letter with the bar code.

================================================================================================

UPDATE: Many of our clients have been asking what a self-employment ledger is, since that’s one of the things the IRS says self-employed folks can provide to verify their income. For most states, there’s no official form– anything that clearly breaks down your income and expenses is a “self-employed ledger.”

For an example of a self-employment ledger that you can use as a template, South Dakota has a good one here.. You don’t have to copy this exactly, but this should give you a good idea of what kind of info the IRS is asking you to provide in a self-employment ledger.

And for more on income verification, Consumers Union has a good guide here.

Here - we’ve provided a sample template which you can use in preparing your correspondence with the Healthcare Marketplace. - See below

——————————————————--

Sam Sample

123 Carolina Way

Western, NC 12345

Marketplace Application #: 123456789 - “ Be sure to include this number “

Proof of Yearly Income for 2017

Dear Insurance Marketplace,

I am self-employed as a ___________ . I work an average of ___ hrs per week, ___ weeks per year.

[Provide here a few examples of your clients, the jobs performed, and the income you made from these jobs. Do a rough calculation to project your 2017 income.]

Total Estimated Income for 2017: $__________

I will file a 2017 federal tax return reflecting this source of income.

Sincerely,

Sam Sample

This can be confusing and difficult for some folks, but the government isn’t asking you to be a fortune teller. If you have hard evidence that your income will go up or down in 2017, send it in to the Marketplace. Otherwise, your proof of your yearly income for 2016 is sufficient.

AND – Most Important - The Marketplace wants verification that you WILL have taxable income for 2017.

Your premium discount is technically an “ IRS “ thing – advanceable premium tax credit

Step 3.

Print this information on EACH PAGE of EACH DOCUMENT

- Your Full Legal Name

- Your Date of Birth

- The State of your Residence

- Application ID # ______________(you'll find this on the top of your eligibility letter)

Step 4.

Please scan all of these documents in .pdf format and send all documents to [email protected]

WE will check it over, make sure you have everything that's needed and upload it to your Healthcare account.

If you cannot scan your documents, send us a COPY of all of your documents to:

Trout Insurance

PO Box 1414

Weaverville, NC 28787

Send all your information include the last page of the eligibility letter with the bar code.

================================================================================================

UPDATE: Many of our clients have been asking what a self-employment ledger is, since that’s one of the things the IRS says self-employed folks can provide to verify their income. For most states, there’s no official form– anything that clearly breaks down your income and expenses is a “self-employed ledger.”

For an example of a self-employment ledger that you can use as a template, South Dakota has a good one here.. You don’t have to copy this exactly, but this should give you a good idea of what kind of info the IRS is asking you to provide in a self-employment ledger.

And for more on income verification, Consumers Union has a good guide here.

Here - we’ve provided a sample template which you can use in preparing your correspondence with the Healthcare Marketplace. - See below

——————————————————--

Sam Sample

123 Carolina Way

Western, NC 12345

Marketplace Application #: 123456789 - “ Be sure to include this number “

Proof of Yearly Income for 2017

Dear Insurance Marketplace,

I am self-employed as a ___________ . I work an average of ___ hrs per week, ___ weeks per year.

[Provide here a few examples of your clients, the jobs performed, and the income you made from these jobs. Do a rough calculation to project your 2017 income.]

Total Estimated Income for 2017: $__________

I will file a 2017 federal tax return reflecting this source of income.

Sincerely,

Sam Sample