-

Insurance

- Trout Team

-

Resources

-

Community

- 50+ WNC Articles

- Understanding Medicare 2024

- Weaverville Primary Spring Fling

- Alignment's 5-Star Switch

- Employer Networking w/ Just Economics

- FALLing with Families

- Blue Ridge Pride Festival

- Goombay & YMI

- YMI Winter Coat Drive

- Medicare Seminar

- Art in Autumn + MANNA

- Music on Main

- Western Women's Business Center Conference

- Mural on Main Street

- Back to School

- Weaverology

- Contact Us

0 Comments

2020 Medicare Parts A & B Premiums and Deductibles

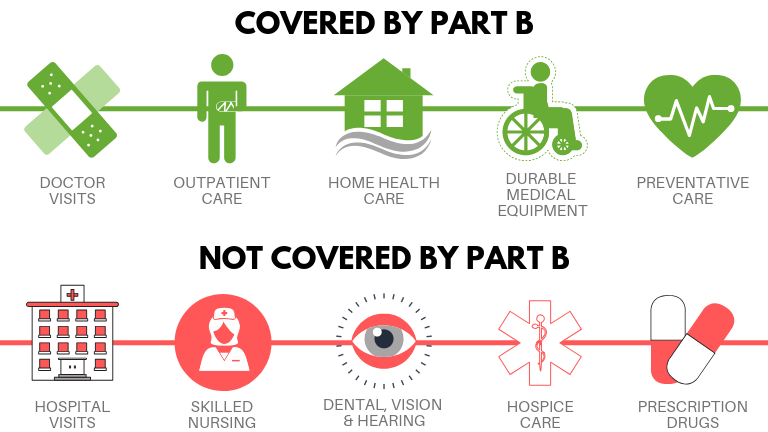

On November 8, 2019, the Centers for Medicare & Medicaid Services (CMS) released the 2020 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs. Medicare Part B Premiums/Deductibles Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. Manna Fundraiser SuccessTrout Insurance sponsored a fundraiser for Manna Foods on Saturday, October 26. Dave baked brownies and brewed hot apple cider. We matched donations of both food and dollars. We are happy to announce that we delivered 8 boxes of canned goods and $300 to Manna to help keep our community well fed. Many thanks to all who contributed! Senior Fitness ResourcesMany of our insurance partners offer discounted or free memberships for folks on Medicare to attend local fitness facilities. These include the YMCA, YWCA, Gold’s Gym, Workout Anytime and many others. We work with Physio physical therapy on Merrimon Avenue, who offer a variety of classes and therapies, plus Haywood Regional Fitness, who features a great facility and super pool! New Benefits on Blue Cross Advantage PlansAs we come into Open Enrollment for individual health insurance, Blue Cross is offering expanded benefits on their Gold and Silver plans–the first three visits to primary care doctors are covered at 100% with no Copay. We are seeing premiums decrease and are very affordable on their Bronze plans. In many cases, the Marketplace subsidy is greater than the premium, so your monthly responsibility is zero. Marketplace Subsidies and 2020 Income EstimateHealthcare.gov uses your “Modified Adjusted Gross Income" to calculate your premium subsidy. With tax reform passed by Congress in 2017, the 1040 return changed. Your Adjusted Gross income is found on line 7. If you or a family member on your return receives Social Security, the full value – line 5a must be added as well. And be sure to check with your tax or financial specialist. TriTerm Health Insurance PlansFor folks who do not qualify for premium subsidies, health insurance is expensive. One option may be a non–ACA plan. While these plans do not offer the same benefits, they may be the right fit for you. New is “Tri-Term" from United Health Care. Once underwritten, this coverage will renew without further health questions for a day short of 3 years. The Grandkids on HalloweenBen and Julie trick-or-treating in Weaverville, including our office on Main St.– where they know Dave is going to have some treats!

For many, the term insurance is thrown around very often but not many people understand what exactly it is. The origins of insurance date back all the way to the Code of Hammurabi, a collection of Babylonian laws of 1700 BC, which provided the first credit insurance. But modern-day insurance dates back to 1666 with the Great fire of London which destroyed 13200 homes, which formed the birth of Nicolas Barbon’s office to insure buildings. Insurance is providing protection against financial loss in a number of situations. These situations include loss against one's property, life or health. Life insurance policies provide a certain amount of money when the insured person dies. Health Insurance pays all or covers most of one's medical care, whether it is hospitalization, surgery or a doctor's visit. Property Insurance is bought to protect individuals against financial loss on assets and has two major forms which are Home and Auto insurance. For more about any type of insurance, go to https://www.troutinsurance.com/ and get in touch with a Trout Insurance Agent today.  Hopefully by the time you reach your 60s you will have found some form of a significant other whether it is a wife, divorced or a widow. Having this significant other when it comes to Medicare can be an asset in some situations. Just like any other person, the first and most important thing to determine whether or not your spouse's Medicare can cover you is whether or not you are eligible. To be eligible you must be 65 or over or have ESRD. If these do not apply, then you need to take a further step to be eligible for Part A insurance. The scenarios are that you must have been married for at least a year, divorced and previously married for 10 years while being single now. And a widow for at least 9 months; all with the regulation that your spouse is now eligible for healthcare. To find out more about whether you can get Medicare through your spouse, contact a Troutt Insurance agent  Are you in anyway unhappy with the Medicare part A&B that you have? Well Medicare Part C may be the perfect option for you, which is known as Medicare advantage. What a Medicare advantage does is that it helps cover medical costs, doctors' visits and other medical services plus prescription drug coverage if wanted. When you want to sign up for Medicare Part C it is important to understand the 5 different plans that are available:

A Medicare card is very important and should always be kept safe, but sometimes life just does not work like that. It can get lost or damaged and the question then is, what to do now? We have some good news for you. Replacing your Medicare in 2019 is not very difficult, in addition to this, the old Medicare cards are being replaced with new ones that will not include your social security number. Before you can even lose the card, try by all means to keep a copy of the original one in the event that it does go missing. Getting the card replaced online is the best option, all you need to do is to go to the Social Security Website and create a “My Social Security” account. Once you have logged I, visit the documents tab. You will find an option that asks them to mail you a replacement card where the sight will ask you for your credentials. The card may take about 30 days to replace, for any more information about this process call a Trout Insurance Agent today. Medicare Advantage Open Enrollment Period

|

“We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or call 1.800.Medicare to get information on all of your options.”

Trout Insurance is an independent authorized agency licensed to sell and promote products from Blue Cross and Blue Shield of North Carolina (Blue Cross NC). The content contained in this site is maintained by Trout Insurance. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association. ®, SM Registered marks of the Blue Cross and Blue Shield Association.”

|

Effective June 28, 2024; Jessica Cody & Jeremy Sheridan are no longer associated or appointed with or through Trout Insurance Services, Inc.

They may be reached at 828-713-8640 – Cody, 828-606-7994 – Sheridan.

This is an amiable separation and they have our confidence they will continue to act as the professional agents as they have demonstrated over the years with TIS. Our agreement includes provisions that they will retain the agreed policies which they previously directly managed under the Trout Insurance agency license. They will be initiating “Agent of Record Transfers “ to their new agency and /or insurance companies and we will honor those requests. Until those transfers are effective, Trout Insurance retains the fiduciary responsibility under our North Carolina Department of Insurance license & obligations to service your policy. Our commitment is to do so in a polite, effective and efficient manner.

Please send any and all requests and questions to this designated email address: [email protected] or call 828 – 519-5218. these are monitored daily. Please allow three working days for our response and resolution. Please further note that policy changes may not be changed or bound via voicemail or merely email. Per insurance regulations, a licensed agent appointed by that company must make the change.

They may be reached at 828-713-8640 – Cody, 828-606-7994 – Sheridan.

This is an amiable separation and they have our confidence they will continue to act as the professional agents as they have demonstrated over the years with TIS. Our agreement includes provisions that they will retain the agreed policies which they previously directly managed under the Trout Insurance agency license. They will be initiating “Agent of Record Transfers “ to their new agency and /or insurance companies and we will honor those requests. Until those transfers are effective, Trout Insurance retains the fiduciary responsibility under our North Carolina Department of Insurance license & obligations to service your policy. Our commitment is to do so in a polite, effective and efficient manner.

Please send any and all requests and questions to this designated email address: [email protected] or call 828 – 519-5218. these are monitored daily. Please allow three working days for our response and resolution. Please further note that policy changes may not be changed or bound via voicemail or merely email. Per insurance regulations, a licensed agent appointed by that company must make the change.

-

Insurance

- Trout Team

-

Resources

-

Community

- 50+ WNC Articles

- Understanding Medicare 2024

- Weaverville Primary Spring Fling

- Alignment's 5-Star Switch

- Employer Networking w/ Just Economics

- FALLing with Families

- Blue Ridge Pride Festival

- Goombay & YMI

- YMI Winter Coat Drive

- Medicare Seminar

- Art in Autumn + MANNA

- Music on Main

- Western Women's Business Center Conference

- Mural on Main Street

- Back to School

- Weaverology

- Contact Us

RSS Feed

RSS Feed